If you have a background of having auto insurance policy policies without filing insurance claims, you'll obtain more affordable rates than somebody who has filed insurance claims in the past.: Automobiles that are driven less often are less most likely to be entailed in a crash or various other harmful event. Cars with reduced yearly gas mileage https://s3.ap-northeast-2.wasabisys.com may get a little reduced prices.

To locate the most effective vehicle insurance policy for you, you should comparison shop online or talk with an insurance policy representative or broker. You can, but be certain to track the insurance coverages picked by you and offered by insurance providers to make a reasonable comparison. You can who can assist you discover the finest mix of price and also fit.

Independent agents help several insurance policy business as well as can contrast among them, while restricted representatives help just one insurance provider. Given the different score techniques and also aspects utilized by insurance firms, no single insurance provider will be best for everyone - car insurance. To better understand your regular car insurance policy expense, invest a long time contrasting quotes across business with your selected technique.

Just how much is vehicle insurance coverage? The average price of cars and truck insurance coverage is $1,655 each year for full insurance coverage, according to 2022 price data. However due to the fact that vehicle insurance costs are based on even more than a lots private rating factors, the real cost might vary for each chauffeur. Right here are some crucial realities concerning automobile insurance policy prices: Bankrate insight New York, Louisiana and Florida are the three most expensive states for car insurance coverage on standard.

Facts + Statistics: Auto Insurance - Iii Things To Know Before You Buy

auto cheaper cars liability cars

auto cheaper cars liability cars

Having a serious violation like a DUI on your motor automobile record might raise your car insurance coverage costs by 88% on standard. Teen male motorists might pay $807 more for vehicle insurance policy on typical contrasted to teen women motorists.

cars low-cost auto insurance credit insure

cars low-cost auto insurance credit insure

The table listed below displays the ordinary annual as well as monthly premiums for some of the biggest car insurance coverage companies in the nation by market share. We have actually additionally calculated a Bankrate Rating on a range of 0. cheaper car.

insurers affordable cheaper car insurance car insurance

insurers affordable cheaper car insurance car insurance

Keep in mind that your age will not influence your premium if you live in Hawaii or Massachusetts, as state regulations prohibit car insurance providers from making use of age as a rating factor. In addition, gender impacts your costs in a lot of states.

Being associated with an at-fault accident will certainly have a result on your car insurance coverage. auto. The quantity of time it will remain on your driving document depends on the intensity of the accident and also state laws. As one of the most significant driving incidents, obtaining a DUI sentence normally raises your vehicle insurance costs even more than an at-fault mishap or speeding ticket.

The What Is Gap Insurance? And What Does It Actually Stand For? Ideas

Just how a lot does car insurance policy price by debt rating? This means that, in basic, the much better your debt ranking, the reduced your premium - cars., not a credit rating score.

These shared features can include: The high price tag of these vehicles often come with expensive parts and also specialized knowledge to repair in the event of a case.

Insurance holders who drive fewer miles a year usually receive lower prices (although this gas mileage designation varies by company). How to locate the very best automobile insurance prices, Purchasing auto insurance policy does not have to indicate costing a fortune; there are methods to conserve. prices. Price cuts are just one of the most effective means to decrease your premium.

Therefore, insurance specialists may recommend considering complete insurance coverage vehicle insurance relying on what cars you are guaranteeing and also what properties you have in your name. For instance, if your car is financed or leased, it's most likely that you will need to lug complete insurance coverage on your car. Full coverage usually describes higher liability limits and even more insurance coverage choices, like accident as well as extensive, to cover your automobile's damages.

The 6-Minute Rule for Michigan Average Car Insurance Rates Drop Significantly, But ...

liability cheaper auto insurance vehicle cheap car insurance

liability cheaper auto insurance vehicle cheap car insurance

While complete insurance coverage cars and truck insurance policy doesn't have a set meaning, it usually describes cars and truck insurance policy that has protection alternatives past the state minimum limitations. A lot of full insurance coverage automobile insurance policy will certainly consist of medical settlements protection, along with thorough insurance coverage and also accident protection to insure the car. Having this added coverage does mean that your car insurance might be much more pricey than if you were just lugging the minimum obligation limits, but the advantage is that it may decrease your out-of-pocket costs in case of a crash.

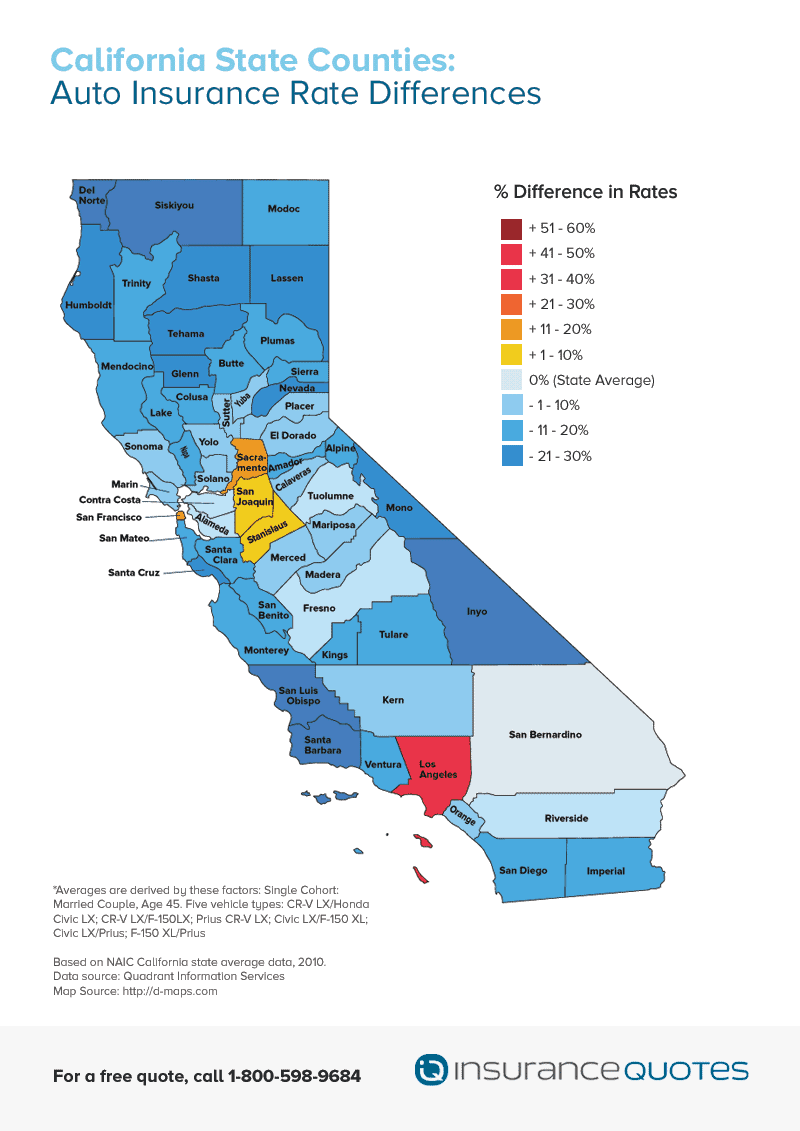

Insurance firms submit new rates with the divisions of insurance in the states they serve yearly, so your premium might be subject to rises or reduces that reflect these new rates. Technique, Bankrate uses Quadrant Information Provider to analyze 2022 prices for all ZIP codes and also providers in all 50 states and Washington, D.C.

Our base profile drivers have a 2020 Toyota Camry, commute 5 days a week and drive 12,000 miles every year. These are example rates and should just be used for relative purposes (cheaper). Prices were computed by examining our base profile with the ages 18-60 (base: 40 years) applied. Depending upon age, chauffeurs might be a renter or property owner.

Bankrate ratings, Bankrate Ratings mainly reflect a heavy rank of industry-standard ratings for monetary stamina as well as client experience in addition to evaluation of priced quote yearly premiums from Quadrant Information Solutions, extending all 50 states as well as Washington, D.C. We understand it is necessary for drivers to be confident their economic defense covers the likeliest dangers, is priced competitively as well as is offered by a financially-sound business with a history of favorable customer assistance (risks).

Little Known Facts About How Much Should I Be Paying For Car Insurance?.

According to the Centers for Condition Control as well as Prevention, motorists ages 15 to 19 are four times more most likely to collapse than older drivers, making cars and truck collisions the No. 1 cause of death for teens. Even teenagers with clean crash records will certainly face high auto insurance rates for numerous years due to their absence of driving experience.

, however buying a cars and truck for the teen as well as placing him on his own policy isn't one of them. The average annual price priced estimate for a teen vehicle driver is $2,267.

The ideal means to hold rates down is to make certain your teen maintains a tidy driving record - low-cost auto insurance. Adding a teen to your insurance plan will no question enhance your prices, however there are points you can do to offset the brand-new expenses and also lower your automobile expenses.

"Motorists must take supply of what coverages are offered and also identify what protection they need. It's additionally essential to go shopping around between various car insurance providers to see which one supplies the finest protection for the ideal value.

The 8-Second Trick For Commercial Auto Insurance Cost - Insureon

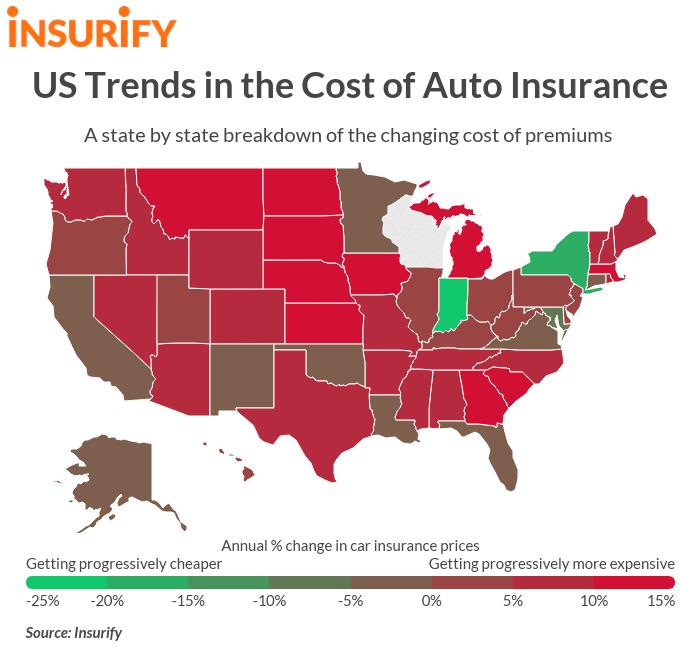

Some elements that affect a location's automobile insurance coverage costs include the cost of repair services in that state, costs of medical help as well as the prominence of all-natural disasters. "A few of one of the most essential variables are the kinds of vehicles in each state, the typical expense of clinical treatment, the frequency and also intensity of accidents, direct exposure to all-natural disaster damage as well as the rate of car theft and also vandalism," the study states - affordable.

On the reverse side, Louisiana drivers see the highest possible costs with an average of $2,154 per year, or $180 per month. Regardless of what state vehicle drivers are in, there are still several means to guarantee they are paying the finest cost for their vehicle insurance, including comparing car insurance estimates from multiple carriers. affordable auto insurance.

There are numerous variables that figure out the expense of vehicle insurance, and also motorists can take steps proactively to ensure their premiums remain low, or to service lower auto insurance policy costs (cheapest). Right here are a few of the top methods to decrease your auto insurance coverage costs: There are multiple variables that enter into figuring out the price of your car insurance.

A vehicle driver's age as well as sex can also identify their costs, or qualify them for special discounts. As an example, some cars and truck insurance business provide good student price cuts to teen drivers. When it comes to automobile insurance, commitment does not pay - automobile. As a motorist's scenario adjustments - such as their age or driving history - the rates and price cuts offered to them might change.

Some Known Details About Car Insurance - Volume 5 - Page 3 - Google Books Result

Go to Trustworthy to submit your info when and watch quotes for automobile insurance coverage rates from multiple automobile insurance companies. Car insurance provider utilize a driver's credit rating as one aspect that determines the rate they will pay. Drivers with poor credit report might pay a lot greater premiums than a driver with great credit report.

In 2018 the cost of car insurance coverage went up 4. It's typically far better to pay car insurance coverage in full - liability.

If you desire to pay month-to-month, you might be able to obtain a discount rate by making use of electronic funds transfer (EFT) for the settlements - liability. Among the very best ways to decrease your vehicle insurance policy cost is to compare quotes from multiple firms. Because cost can vary by thousands of bucks amongst insurance companies for the same insurance coverage, looking around can actually pay off.

auto auto insurance affordable auto insurance prices

auto auto insurance affordable auto insurance prices

Vehicle insurance coverage rates are not less costly based on whether you possess an automobile or money it. Insurance policy can end up being less costly when you possess the auto due to the fact that you have much more choice in protection.

Not known Incorrect Statements About Starter Replacement Cost: What You Need To Know About - Way

The average automobile insurance policy expense for full coverage in the United States is $1,150 per year, or concerning $97 per month. A 'full protection auto insurance policy' policy covers you in most of them - vehicle insurance.