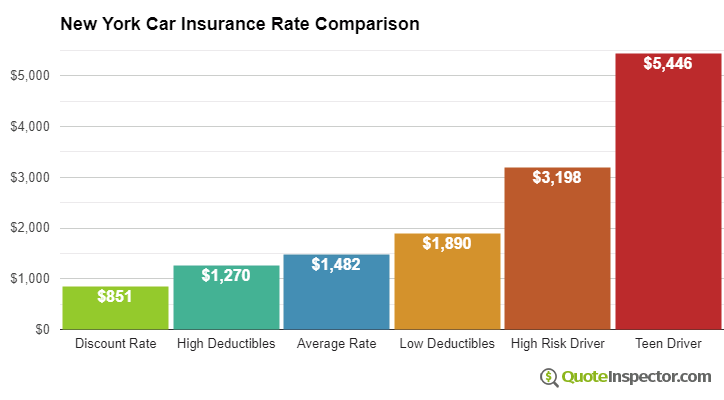

To much better protect on your own and your residential or commercial property prior to a mishap, it's a good concept to include more insurance coverage such as comprehensive or crash insurance policy to help delay out-of-pocket expenses. New York City motorists pay several of the most expensive rates in the country, however there are means to conserve: Safe motorist discount rate - A discount for motorists without relocating offenses or crashes on their driving record. cars.

Insurance policy prices vary from driver-to-driver, so go shopping around to find the cheapest prices for you. Just how much is automobile insurance policy in New york Visit this website city City monthly? The ordinary month-to-month expense of auto insurance coverage in New york city City is $402 for full protection. That's greater than the average cost in the state of New york city.

cheap auto insurance cheapest perks car

If you drive in New York, you'll require car insurance policy. automobile. Discovering out exactly how much that'll cost you is the primary step to ensuring you prepare to obtain a plan that works for your driving behaviors in the Empire State. The first thing you require to know is that it's expensive.

Learn whatever you need to understand concerning just how much car insurance remains in New York as well as find exactly how you can obtain the finest policy for your demands and budget. NY Auto Insurance Policy Costs, The ordinary expense of auto insurance in New york city can differ fairly a bit relying on the resource of the info.

Facts About How Much Is A Car Insurance In New York Per Year? - Quora Uncovered

On the other hand, Worth Penguin puts the typical expense at $2752 each year, yet they made use of a particular profile for their chauffeur. New york city City rates are particularly high, and with these city insurance plan evaluating the scales, the average costs for the state also run high. New york city City premiums are 20 percent greater than the national standard, according to The Easy Buck.

Additionally, not all companies evaluate every one of these aspects evenly. cheap car insurance. Determining danger is a process that differs a fair bit in between companies, so you'll need to search to find the very best offer. Offered their diversity as well as the quantity of personalized information going into your premiums, there is nobody answer for the most inexpensive firm to get insurance from.

Exactly how to Discover the very best Insurance in New York City, If you're trying to find one of the most economical insurance policy possible while still giving the appropriate insurance coverage you require, you'll need to do your study. Every business will certainly have differing prices for the very same kind of coverage, so never ever work out for the first offer that comes your method (car insurance).

To find the ideal deal on insurance policy, you'll have to compare your alternatives. That implies getting quotes from a large range of companies for the kind of protection you're specifically looking for.

Average Car Insurance Rates By Age And State (May 2022) for Beginners

It's not uncommon for a teen to set you back 4 times as a lot to insure as a middle-aged person. Just transforming 20 as well as not being a teen anymore can minimize your insurance coverage premium by thousands of dollars a year. Generally, however, age 26 is the factor at which you'll see significant declines in premium prices.

Your driving background also plays a major role in your insurance prices. At-fault mishaps can place your costs up by around $70 a year, and that's just the beginning (low-cost auto insurance).

auto insured car affordable car insurance risks

auto insured car affordable car insurance risks

Sources: This content is created as well as maintained by a 3rd party, and imported onto this page to help customers provide their email addresses. You might be able to locate even more details concerning this and also comparable material at.

Accident protection (PIP) is likewise called for. It covers you, your travelers and also various other authorized drivers of your cars and truck who are wounded while in your auto - perks. PIP additionally covers you as well as your household members if you are hurt while riding in a person else's automobile or if struck by another automobile while walking.

Facts About New York City Car Insurance - 2022 Rates + Cheapest To ... Revealed

You should have $50,000 in protection. Without insurance motorist bodily injury covers medical expenditures for you as well as your guests if hurt when hit by a motorist with no insurance policy. You must have 25/50 protection. This suggests your insurance provider pays up to $25,000 per individual and also $50,000 in total if there are two or even more individuals injured.

cheap car insurance dui perks trucks

cheap car insurance dui perks trucks

To obtain a cars and truck insurance policy, you can just contrast store online, discover the finest plan for your requirements as well as purchase it - perks. What are the elements that impact the vehicle insurance coverage costs? As we mentioned earlier, vehicle insurance provider look at a range of risk elements when determining your prices.

Evaluation the 13 primary automobile insurance coverage ranking aspects to find out more on the topic. Exactly how moving to a various state might impact your automobile insurance costs? Place matters to vehicle insurer, so if you cross the state or to a new state, be prepared for your costs to change.

Higher claims in that area will result in higher rates - insurance companies. Keep in mind to car insurance coverage contrast store with at the very least three business to locate out that in your location offers the ideal rates.

How Easy Ways To Save Money On New York Car Insurance can Save You Time, Stress, and Money.

: An insurance provider needs to collect a $10 charge at the time of the addition or replacement and afterwards upon the plan's wedding anniversary date.: An insurance company must gather a $5 cost per insured automobile when the plan is initially issued and upon revival of the policy, but the overall charge accumulated must not surpass $10 per guaranteed vehicle annually (insure).

Solution: The Division does not sustain the splitting of the Electric motor Lorry Police charge as well as such collection is not permitted. The whole fee must be paid at the beginning of the plan duration or when a lorry is contributed to or replaced on a policy. Answer: A policy might be terminated for nonpayment of the Car Police Cost.

Left out from the charge are motorbikes, electrically-driven mobility help tools operated or driven by an individual with a special needs, trailers, semitrailers, instructor or home trailers, lorries which run only upon rails or tracks, snowmobiles and all-terrain vehicles as explained in Articles forty-seven and also forty-eight B of the Car and Website traffic Law, fire as well as cops automobiles (besides ambulances), farm-type tractors and all surface kind automobiles used exclusively for farming or for snow plowing (other than for hire), ranch devices consisting of self-propelled makers made use of specifically in expanding, gathering or handling produce, as well as self-propelled caterpillar or crawler-type tools while being operated on the contract site - vans.

affordable auto insurance accident cheapest auto insurance auto

affordable auto insurance accident cheapest auto insurance auto

On the other hand, to get an auto insurance plan, you can simply contrast store online, locate the best plan for your needs as well as acquire it - cars. What are the variables that impact the cars and truck insurance premium? As we discussed earlier, car insurance provider check out a range of threat aspects when determining your rates.

Everything about Cheap Car Insurance In Syracuse, Ny

Testimonial the 13 main cars and truck insurance coverage rating factors for more information on the topic. business insurance. Exactly how relocating to a various state might affect your auto insurance premium? Location matters to vehicle insurer, so if you move throughout the state or to a brand-new state, be planned for your premiums to alter.

Higher insurance claims in that location will certainly result in greater prices. You can take a look at our expense of living calculator tool to see how much rates may transform if you move states. Bear in mind to automobile insurance coverage comparison shop with at least three business to locate out who in your area gives the ideal rates.

: An insurer must gather a $10 fee at the time of the addition or substitute and also after that upon the plan's anniversary date.: An insurance company should accumulate a $5 charge per insured lorry when the plan is initially provided as well as upon revival of the policy, however the complete cost collected need to not go beyond $10 per guaranteed vehicle each year.

cheap auto insurance insurance affordable auto insurance insurers

cheap auto insurance insurance affordable auto insurance insurers

Answer: The Division does not support the splitting of the Motor Car Police charge and such collection is not permitted (cheaper car insurance). The whole cost needs to be paid at the beginning of the plan period or when a lorry is included to or changed on a policy. Response: A plan may be terminated for nonpayment of the Automobile Law Enforcement Cost.

Examine This Report on Car Insurance Rates By State 2022: Most & Least Expensive

Omitted from the charge are motorbikes, electrically-driven movement aid devices ran or driven by a person with a disability, trailers, semitrailers, train or residence trailers, cars which run only upon rails or tracks, snowmobiles and also all-terrain lorries as described in Articles forty-seven as well as forty-eight B of the Lorry and also Website traffic Law, fire and also police car (various other than rescues), farm-type tractors and all surface type vehicles made use of solely for farming or for snow plowing (besides for hire), farm equipment consisting of self-propelled equipments used exclusively in growing, collecting or dealing with fruit and vegetables, and self-propelled caterpillar or crawler-type equipment while being run on the agreement website. cheaper car.

Meanwhile, to obtain an auto insurance coverage policy, you can just contrast shop online, find the finest policy for your requirements as well as buy it. What are the aspects that impact the vehicle insurance coverage costs? As we mentioned previously, cars and truck insurance provider take a look at a variety of risk aspects when identifying your prices. car insured.

Just how moving to a different state might influence your vehicle insurance coverage costs? Location matters to cars and truck insurance coverage companies, so if you relocate across the state or to a new state, be prepared for your costs to change.

Higher insurance claims in that area will result in higher rates. Keep in mind to vehicle insurance policy comparison store with at least three business to discover out who in your area provides the ideal rates - cheapest car insurance.

The 6-Second Trick For What's The Average Cost Of Car Insurance In 2020? - Business ...

: An insurer should gather a $10 cost at the time of the addition or replacement and thereafter upon the plan's wedding anniversary date.: An insurance provider must collect a $5 cost per guaranteed car when the policy is initially issued as well as upon renewal of the policy, however the complete charge accumulated need to not go beyond $10 per insured vehicle each year.

Answer: The Department does not sustain the splitting of the Automobile Regulation Enforcement cost as well as such collection is not permitted. The entire cost should be paid at the beginning of the policy duration or when a car is contributed to or changed on a plan (money). Solution: A plan might be cancelled for nonpayment of the Automobile Law Enforcement Cost.

Left out from the fee are motorcycles, electrically-driven movement assistance tools ran or driven by an individual with an impairment, trailers, semitrailers, train or residence trailers, lorries which run just upon rails or tracks, snow sleds as well as all-terrain automobiles as described in Articles forty-seven as well as forty-eight B of the Automobile and Website traffic Regulation, fire as well as cops lorries (apart from rescues), farm-type tractors and all surface type cars made use of solely for agricultural or for snow plowing (besides for hire), ranch equipment including self-propelled machines used solely in expanding, harvesting or managing produce, and self-propelled caterpillar or crawler-type equipment while being operated the contract website (insurance).